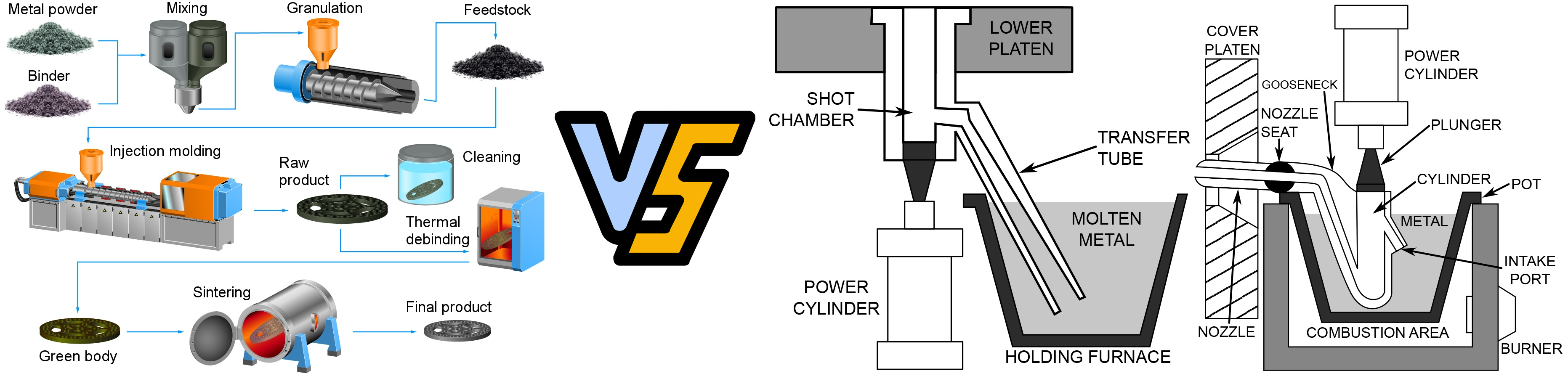

Технология MIM объединяет технические преимущества литья пластмасс под давлением и порошковой металлургии. Она не только обладает преимуществами традиционных процессов порошковой металлургии, такими как меньшее количество этапов, отсутствие резки или ее меньшее количество, а также высокие экономические выгоды, но и преодолевает основные недостатки традиционных продуктов порошковой металлургии, такие как неровные материалы, низкие механические свойства, тонкие стенки, которые трудно формовать, и сложные структуры. Она подходит для массового производства небольших, точных, трехмерных сложных форм и металлических деталей со специальными требованиями. Процесс MIM стал новым типом технологии «формования почти чистой формы» с быстрым развитием и большими перспективами в области международной порошковой металлургии и провозглашается отраслью как «самая горячая технология формования компонентов» на сегодняшний день.

Общее состояние развития рынка MIM

(1) Общее состояние развития мирового рынка MIM В последние годы, под влиянием множества областей, таких как электроника, автомобили, медицинская помощь, оборудование и машины, мировой рынок MIM неуклонно рос. Согласно данным Maximize Market Research, размер мирового рынка MIM в 2016 году составил 2,46 млрд долларов США, а в 2018 году размер рынка увеличился до 2,87 млрд долларов США. Ожидается, что в 2026 году он достигнет 5,26 млрд долларов США, что соответствует совокупному годовому темпу роста (CAGR) в 7,87% с 2019 по 2026 год. В будущем, под влиянием быстрого роста электронной продукции и замены традиционных производственных деталей на детали производства MIM, мировой рынок MIM продолжит развиваться в положительном направлении.

С точки зрения глобального регионального распределения китайский рынок MIM занимает около 40% мирового рынка, что делает его крупнейшим в мире; североамериканские и европейский рынки MIM занимают 17% мирового рынка и также являются важными рынками в мире.

С точки зрения нисходящих приложений североамериканские MIM-приложения в основном распространены в сферах вооружения и медицины, занимая 33% и 33% рынка соответственно; европейские MIM-приложения в основном распространены в сферах автомобилестроения и вооружения, занимая 22% и 21% рынка соответственно.

(2) Общее состояние развития рынка MIM в моей стране С постепенным развитием технологии MIM и дальнейшим углублением понимания технологии MIM постепенно увеличивалось применение продукции MIM в электронных продуктах, автомобилях, медицинском обслуживании, оборудовании, машинах и других областях. С 2012 года отрасль MIM в моей стране начала быстро развиваться, и масштаб рынка продолжал расширяться. Согласно статистике Отделения порошковой металлургии Китайской ассоциации чугуна и стали, размер внутреннего рынка MIM увеличился до 7,3 млрд юаней в 2020 году, что на 9,0% больше, чем в 2019 году. Согласно прогнозу Центра исследований промышленности Liding, размер рынка MIM достигнет 14,14 млрд юаней в 2026 году.

С точки зрения нисходящих приложений, рыночное применение MIM в Китае сильно отличается от такового в Европе и США. В основном оно распространено в сфере потребительской электроники. В 2020 году мобильные телефоны продолжали сохранять наибольшую долю, но немного снизились, в то время как доля компьютеров, умных носимых устройств и военной продукции значительно увеличилась, медицинская и автомобильная продукция немного увеличилась, а аппаратные и механические изделия значительно сократились. Исходя из продаж, доля областей применения составляет: мобильные телефоны 56,3%, умные носимые устройства 11,7%, компьютеры 8,3%, аппаратное обеспечение (включая машины) 6,9%, медицина 4,5%, автомобили 3,5% и другие (включая военную продукцию) 9,3%.

По состоянию на 2019 год в стране насчитывается более 200 компаний и мастерских по литью металла под давлением (без учета Тайваня), из которых больше всего в регионе дельты реки Чжуцзян — около 110; на втором месте находится регион дельты реки Янцзы — 55; в регионах Пекин-Тяньцзинь-Хэбэй и Шаньдун — около 20; в провинциях Хунань, Цзянси, Аньхой и Фуцзянь — по 14; в Хэнань, Сычуань, Чунцин и других регионах — по 5.

С точки зрения отраслевой конкуренции предприятия MIM в отрасли можно разделить на три конкурентных эшелона в зависимости от масштаба бизнеса: первый эшелон предприятий MIM имеет объем выручки более 200 миллионов юаней, обладает мощным потенциалом в области НИОКР и инноваций, а его основными клиентами являются международные бренды или известные отечественные брендовые предприятия, в основном включая India Indo-MIM, Zhongnan Changlian, Taiwan Shengming Electronics, Jingyan Technology, Fuchi Hi-Tech, Panhai Tonglian, Quanyi Da и т. д.;

Второй эшелон предприятий MIM имеет масштаб доходов от 50 до 200 миллионов юаней, и его конкурентоспособность слабее, чем у первого эшелона. Он в основном производит детали и компоненты MIM для предприятий отечественных брендов, и его концентрация клиентов часто высока; третий эшелон предприятий MIM имеет масштаб доходов менее 50 миллионов юаней, и обычно общие технические возможности НИОКР предприятий слабы, и только небольшие и средние партии продукции MIM производятся путем закупки оборудования и развертывания персонала.

По состоянию на 2024 год в материковой части моей страны насчитывается более 200 предприятий и мастерских по производству MIM, из которых не более 10 предприятий имеют доход, превышающий 200 миллионов юаней. В целом, компания находится в период быстрого развития. Поскольку порог дохода для первого уровня составляет 200 миллионов юаней, ожидается, что компания выйдет на первый уровень, открыв новые сценарии применения и продолжив исследования и разработки.

Share:

Развитие микролитья металлов под давлением в Японии

Состав и свойства твердого сплава