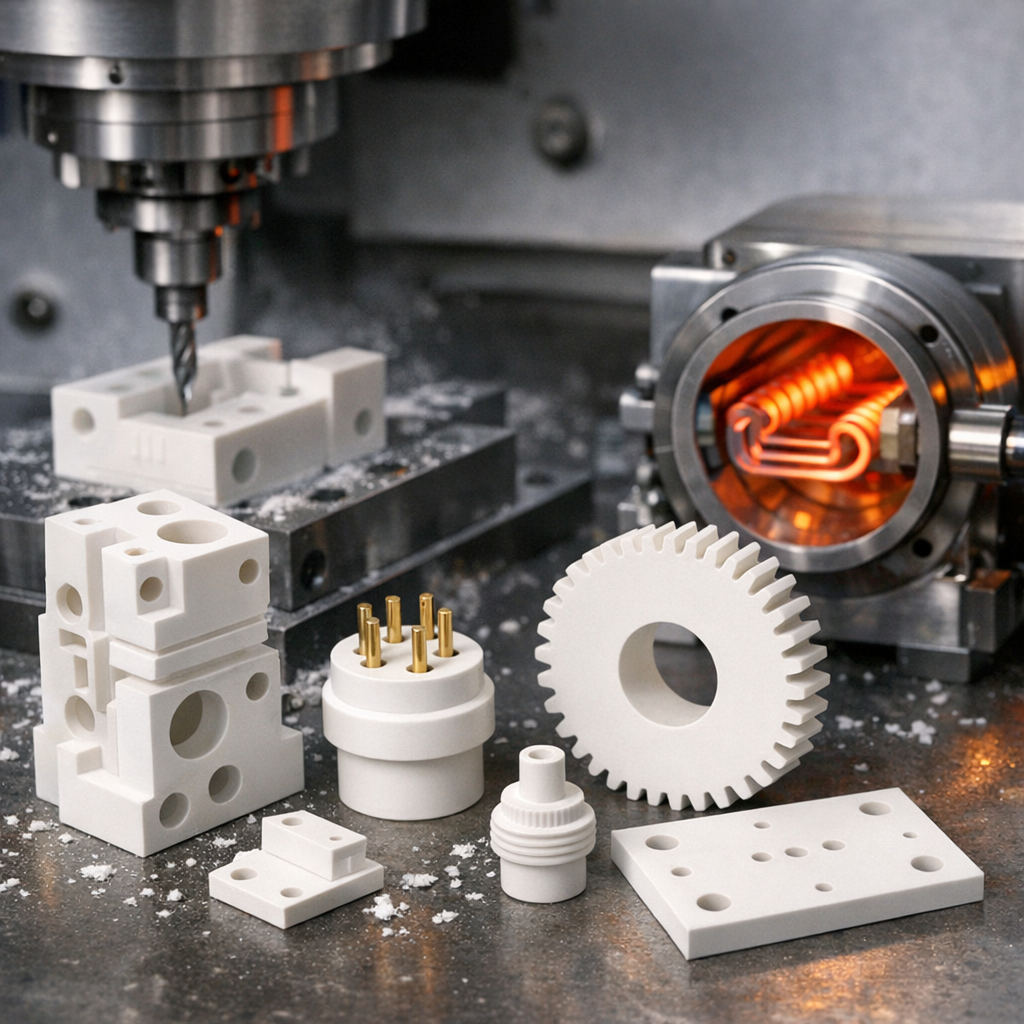

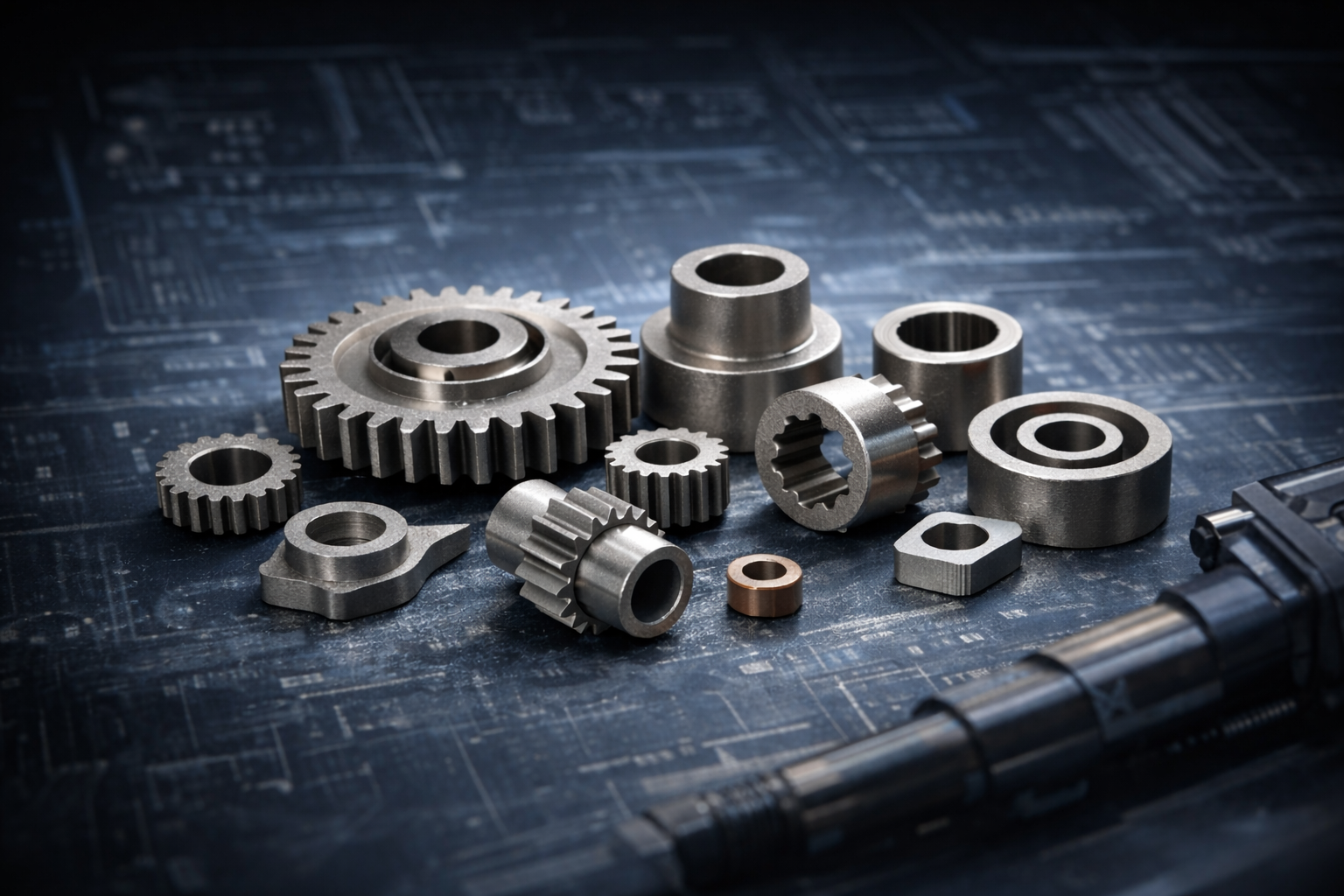

MIM technology combines the technical advantages of plastic injection molding and powder metallurgy. It not only has the advantages of conventional powder metallurgy processes such as fewer steps, no cutting or less cutting, and high economic benefits, but also overcomes the main shortcomings of traditional powder metallurgy products such as uneven materials, low mechanical properties, thin walls that are difficult to form, and complex structures. It is suitable for mass production of small, precise, three-dimensional complex shapes and metal parts with special requirements. The MIM process has become a new type of "near-net-shape forming" technology with rapid development and great prospects in the field of international powder metallurgy, and is hailed by the industry as the "hottest component forming technology" today.

Overall development status of the MIM market

(1) Overall development status of the global MIM market In recent years, driven by multiple fields such as electronics, automobiles, medical care, hardware, and machinery, the global MIM market has grown steadily. According to Maximize Market Research data, the global MIM market size was US$2.46 billion in 2016, and the market size increased to US$2.87 billion in 2018. It is expected to reach US$5.26 billion in 2026, corresponding to a compound annual growth rate (CAGR) of 7.87% from 2019 to 2026. In the future, driven by the rapid growth of electronic products and the replacement of traditional manufacturing parts by MIM manufacturing parts, the global MIM market will continue to develop in a positive direction.

From the perspective of global regional distribution, China's MIM market accounts for about 40% of the global market, making it the world's largest market; North American and European MIM markets account for 17% of the global market, and are also important markets in the world.

From the perspective of downstream applications, North American MIM applications are mainly distributed in the fields of arms and medical, accounting for 33% and 33% of the market respectively; European MIM applications are mainly distributed in the fields of automobiles and arms, accounting for 22% and 21% of the market respectively.

(2) The overall development status of my country's MIM market With the gradual maturity of MIM process technology and the further deepening of the understanding of MIM technology, the application of MIM products in electronic products, automobiles, medical care, hardware, machinery and other fields has gradually increased. Since 2012, my country's MIM industry has begun to develop rapidly, and the market scale has continued to expand. According to statistics from the Powder Metallurgy Branch of the China Iron and Steel Association, the domestic MIM market size increased to 7.3 billion yuan in 2020, an increase of 9.0% compared with 2019. According to the forecast of Liding Industry Research Center, the MIM market size will reach 14.14 billion yuan in 2026.

From the perspective of downstream applications, the market application of MIM in China is quite different from that in Europe and the United States. It is mainly distributed in the field of consumer electronics. In 2020, mobile phones continued to maintain the largest share but declined slightly, while the proportion of computers, smart wearables and military products increased significantly, medical and automotive products increased slightly, and hardware and mechanical products decreased significantly. Based on sales, the proportion of application fields is: mobile phones 56.3%, smart wearables 11.7%, computers 8.3%, hardware (including machinery) 6.9%, medical 4.5%, automobiles 3.5%, and others (including military) 9.3%.

As of 2019, there are more than 200 metal injection molding production companies and workshops in the country (excluding Taiwan), of which the Pearl River Delta region has the most, reaching about 110; the Yangtze River Delta region is second, reaching 55; Beijing-Tianjin-Hebei and Shandong regions have about 20; Hunan, Jiangxi, Anhui and Fujian have 14; Henan, Sichuan, Chongqing and other regions have 5.

From the perspective of industry competition, MIM enterprises in the industry can be divided into three competitive echelons according to business scale: the first echelon of MIM enterprises has a revenue scale of more than 200 million yuan, has strong R&D and innovation capabilities, and its main customers are international brands or well-known domestic brand enterprises, mainly including India Indo-MIM, Zhongnan Changlian, Taiwan Shengming Electronics, Jingyan Technology, Fuchi Hi-Tech, Panhai Tonglian, Quanyi Da, etc.;

The second echelon of MIM enterprises has a revenue scale of 50 million to 200 million yuan, and its competitive strength is weaker than the first echelon. It mainly produces MIM parts and components for domestic brand enterprises, and its customer concentration is often high; the third echelon of MIM enterprises has a revenue scale of less than 50 million yuan, and usually the overall technical R&D capabilities of the enterprises are weak, and only small and medium-sized batches of MIM products are produced through the purchase of equipment and the deployment of personnel.

As of 2024, there are more than 200 MIM production enterprises and workshops in mainland my country, of which no more than 10 enterprises have revenue exceeding 200 million yuan. Overall, the company is in a period of rapid development. Since the revenue threshold for the first tier is 200 million yuan, the company is expected to enter the first tier by opening up new application scenarios and continuing research and development.

Share:

Development of Micro Metal Injection Molding in Japan

Composition and Properties of Cemented Carbide